The Community Investment Tax Credit (CITC) program is a Massachusetts-sponsored program that provides great tax-incentives to donors while supporting Community Development Corporations (or CDCs) across the Commonwealth like North Shore CDC.

Since 2012, the CITC program has grown stronger each year, promoting private investment by individuals and businesses to create homes across the North Shore and state. In 2025, the Executive Office of Housing and Livable Communities awarded North Shore CDC $375,000 in tax credits.

We have limited CITC credits, so please contact Ashley Ganem, Director of Development, at aganem@northshorecdc.org prior to making your gift.

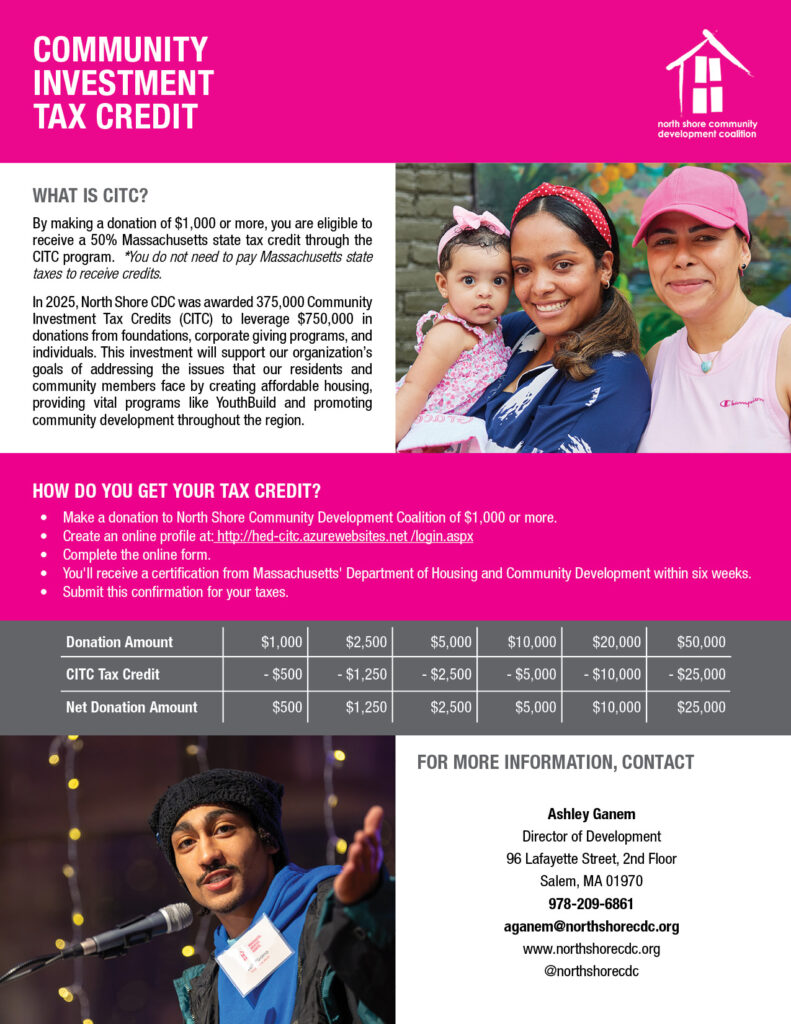

By making a $1,000 or larger investment in North Shore CDC, you receive a 50% state tax credit for the total amount of your gift. You may even qualify for a federal tax deduction (for taxpayers who choose to itemize; check with your tax advisor). Please consult your tax advisor regarding questions specific to tax filing and to determining final out of pocket cost.